Mortgage Rates Are Dropping. What Does That Mean for You?

Mortgage rates have been a hot topic in the housing market over the past 12 months. Compared to the beginning of 2022, rates have risen dramatically. Now they’re dropping, and that has to do with everything happening in the economy.

Nadia Evangelou, Senior Economist and Director of Forecasting at the National Association of Realtors (NAR), explains it well by saying:

“Mortgage rates dropped even further this week as two main factors affecting today's mortgage market became more favorable. Inflation continued to ease while the Federal Reserve switched to a smaller interest rate hike. As a result, according to Freddie Mac, the 30-year fixed mortgage rate fell to 6.31% from 6.33% the previous week.”

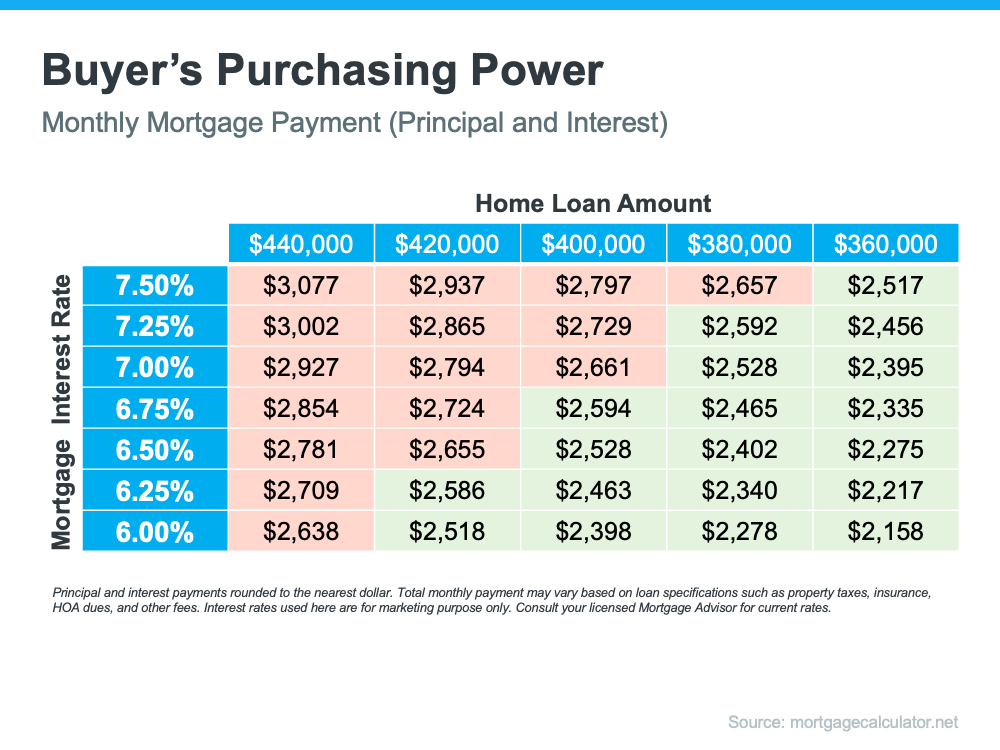

So, what does that mean for your homeownership plans? As mortgage rates fluctuate, they impact your purchasing power by influencing the cost of buying a home. Even a small dip can help boost your purchasing power. Here’s how it works.

The median-priced home according to the National Association of Realtors (NAR) is $379,100. So, let’s assume you want to buy a $400,000 home. If you’re trying to shop at that price point and keep your monthly payment about $2,500-2,600 or below, here’s how your purchasing power can change as mortgage rates move up or down (see chart below). The red shows payments above that threshold and the green indicates a payment within your target range.

This goes to show, even a small quarter-point change in mortgage rates can impact your monthly mortgage payment. That’s why it’s important to work with a trusted real estate professional who follows what the experts are projecting for mortgage rates for the days, months, and year ahead.

Mortgage rates are likely to fluctuate depending on what happens with inflation moving forward, but they have dropped slightly in recent weeks. If a 7% rate was too high for you, it may be time to contact a lender to see if the current rate is more in line with your goal for a monthly housing expense.

Get your home's accurate value.

Instead of a robot and an algorithm, we use our experience and up-to-date MLS data*

- Step 1

- Step 2

We'll be in touch soon!

Our goal is to send your report over within 24-48 hours. In the meantime, hear from our past sellers about their experiences.