Single-Family Home Prices Increase in 98% of 185 Metro Areas in Third Quarter of 2022

The National Association of REALTORS® reported that home prices continued to rise in the third quarter of 2022. Forty-six percent of the metro markets posted double-digit annual price appreciation this quarter compared to 80% in the previous quarter. National median prices rose 8.6% year over year to $398,500. While median home prices rose by 8.6%, year-over-year price appreciation decelerated compared to the previous quarter's 14.2%.

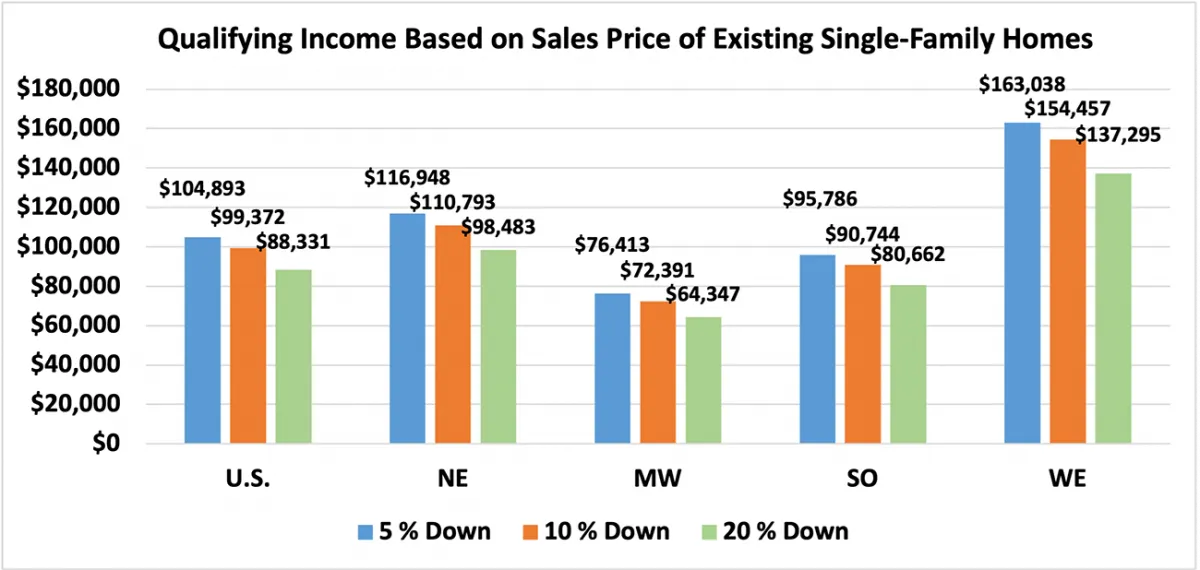

This quarter's monthly mortgage payments on a single-family home increased to $1,840 compared to $1,226 from a year ago. Qualifying median family incomes rose to $88,331 compared to the second quarter of 2022, which was $88,200, and $58,826 a year ago. The effective 30-year fixed mortgage rate increased to 5.65% in the third quarter of 2022 compared to 2.92% one year ago.

Knowing the mortgage rates and the qualifying incomes for down payments will help potential homeowners figure out what metro areas are affordable.

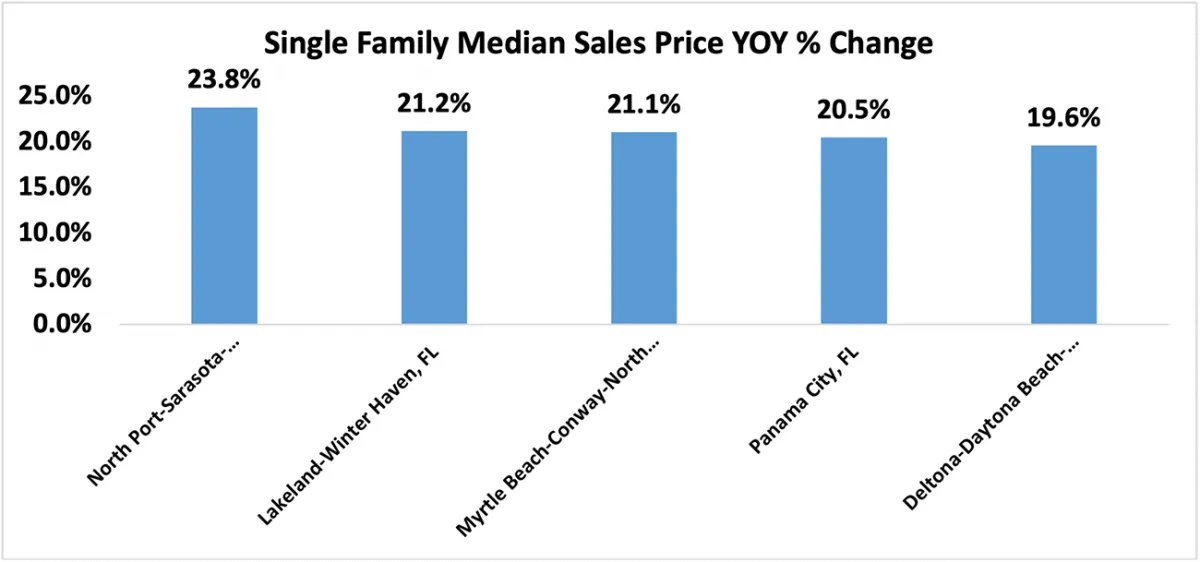

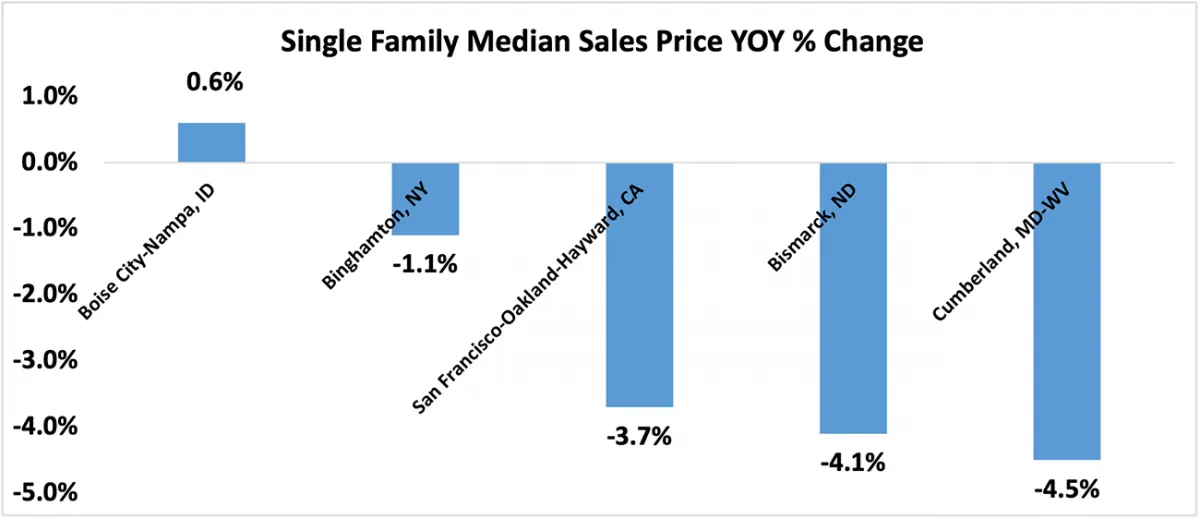

Here is a look at the metro areas with the strongest price growth in the third quarter of 2022, as well as the yearly change in median existing single-family home prices among the top five highest and lowest-growth metro areas of the third quarter of 2022.

The top five single-family metro areas with the highest home price appreciation were North Port-Sarasota-Bradenton, FL (23.8%); Lakeland-Winter Haven, FL (21.2%); Myrtle Beach-Conway-North Myrtle Beach, SC (21.1%); Panama City, FL (20.5%); Deltona-Daytona Beach-Ormond Beach, FL (19.6%).

The bottom five single-family metro areas with the slowest home price appreciation were Boise City-Nampa, ID (0.6%); Binghamton, NY (-1.1%); San Francisco-Oakland-Hayward, CA (-3.7%); Bismarck, ND (-4.1%) and Cumberland, MD-WV (-4.5%).

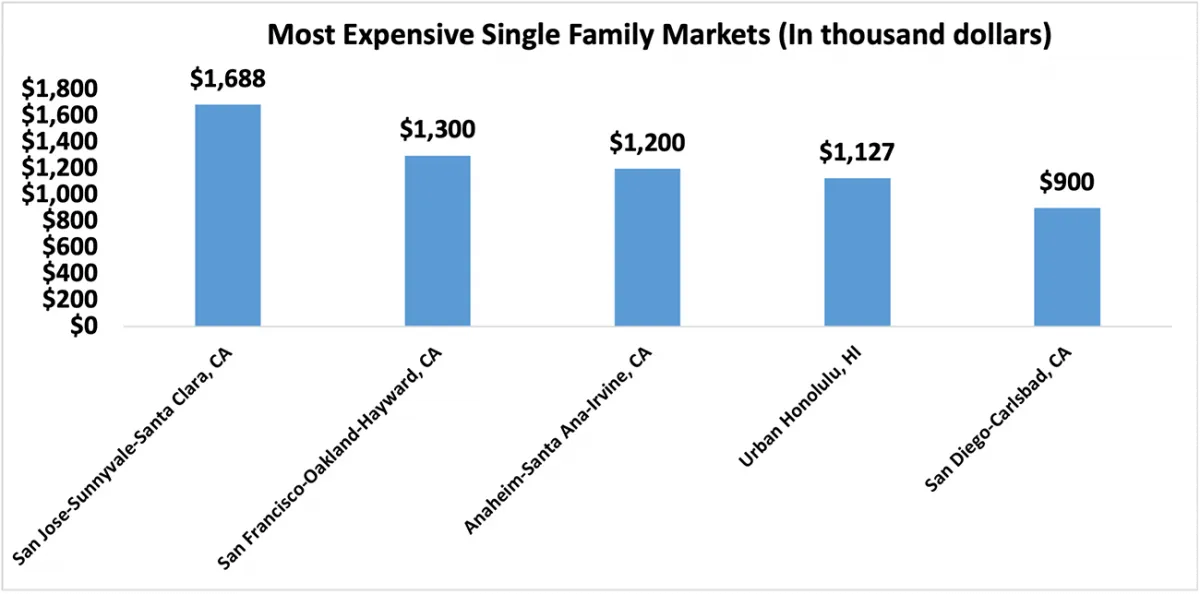

The most expensive metro areas for the third quarter of 2022 were San Jose-Sunnyvale-Santa Clara, CA ($1,688,000); San Francisco-Oakland-Hayward, CA ($1,300,000); Anaheim-Santa Ana-Irvine, CA ($1,200,000), Urban Honolulu, HI ($1,127,000); and San Diego-Carlsbad, CA ($900,000).

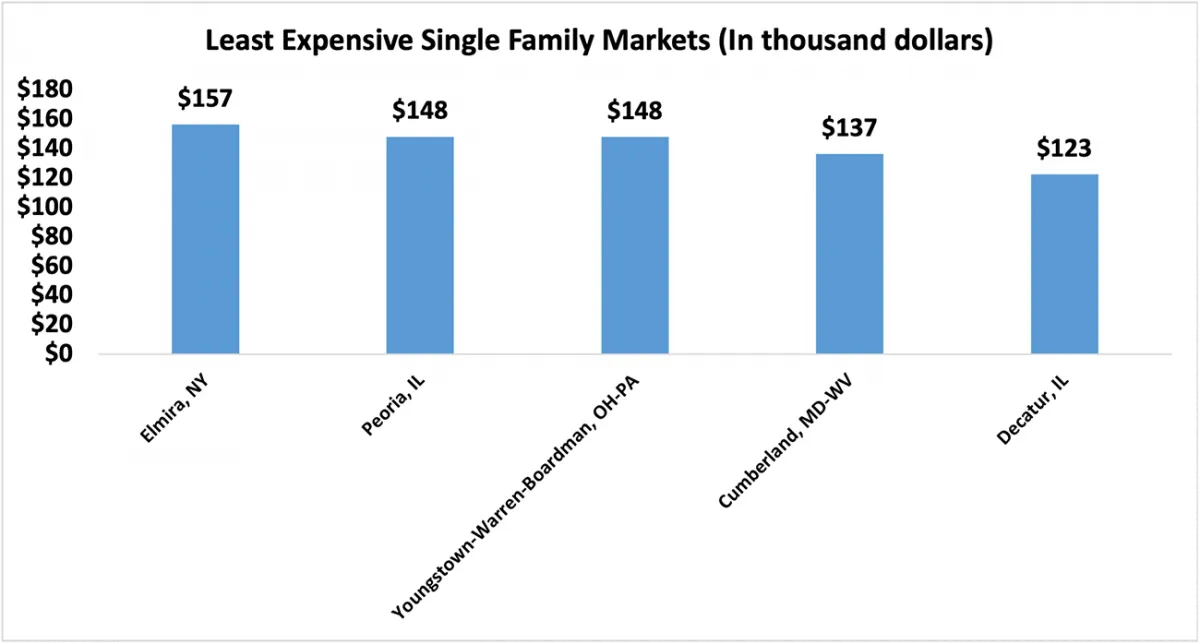

The least expensive metro areas for the third quarter of 2022 were Elmira, NY ($157,000); Peoria, IL ($148,000); Youngstown-Warren-Boardman, OH-PA ($148,000); Cumberland, MD-WV ($137,000), and Decatur, IL ($123,000).

Qualifying Income Based on Sales Price of Existing Single-family Homes for Metropolitan Areas by Region

Nationally, at the 5% down payment threshold, the qualifying income for the third quarter of 2022 was $104,893. At the 10% down-payment mark, the qualifying income was $99,372, and with a 20% down-payment, the income required to qualify for a mortgage was $88,331. The West led all regions with the highest qualifying income, while the Midwest had the lowest income for 5%, 10%, and 20% down payments on single-family homes.

Read Full Story - Michael Hyman Research Data Specialist for the National Association of REALTORS®.

Ready to Take the Next Step?

We want you to feel confident about your next steps as a homebuyer.

Are you a Veteran?

Let us help!

As a Veteran, we specialize in helping Veterans utilize their VA Home Loan Benefits.

Check out our Veteran's Page.

Andy sold it quickly after it sat with another agent!

Our home had been on the market for 4 months with a previous agent. My husband found Andy on a real estate group. Andy was very knowledgeable in my area. He suggested making a few minor updates and listed our house for $30k more than it was previously listed for. It took Andy about 2 weeks after listing it to get 2 offers on my house. We finally closed on our house after an offer of only $5K off of ask.

Verified by RateMyAgent