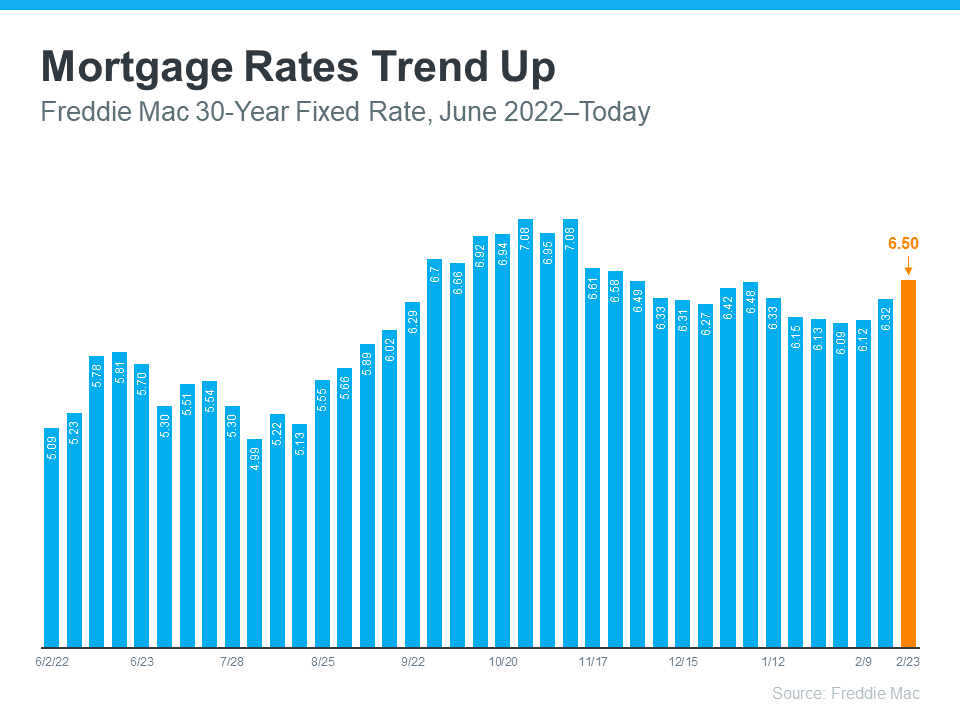

What You Should Know About Rising Mortgage Rates

After steadily falling over the winter, mortgage rates have started to rise in recent weeks. This is concerning to some potential homebuyers as the combination of higher mortgage rates and higher prices have made homes less affordable. So, if you’re planning to purchase a home this year, you too may be wondering if now’s the right time to buy or if you should hold off on your search until rates come back down.

The recent uptick in rates has been driven by what’s happening with inflation. Joel Kan, Vice President and Deputy Chief Economist at the Mortgage Bankers Association (MBA), explains:

“Mortgage rates increased across the board last week, pushed higher by market expectations that inflation will persist, thus requiring the Federal Reserve to keep monetary policy restrictive for a longer time.”

The most recent weekly average 30-year fixed mortgage rate reported by Freddie Mac is 6.5%. It’s the third week in a row that rates have increased and puts them at the highest point they’ve been this year (see graph below):

Advice for Home Shoppers

If you’re thinking about pausing your home search because rates have started to go up again, you may want to reconsider. This could actually be an opportunity to buy the home you’ve been searching for. According to the MBA, mortgage applications declined by 13.3% in just one week, so it appears the rise in mortgage rates is leading some potential homebuyers to pull back on their search for a new home.

So, what does that mean for you? If you stay the course, you’ll likely face less competition among other buyers when you’re looking for a home. This is welcome relief in a market that has so few homes for sale.

Bottom Line

Over the last few weeks, mortgage rates have risen. But that doesn’t mean you should delay your plans to buy a home. In fact, it could mean the opposite if you want to take advantage of less buyer competition. Let’s connect today to explore the options in our local market.

He made the process of easy!! Would highly recommend him and Stephanie.

Andy did a great job!! Even after the buying and selling was done, he still followed up with us. He made the process of easy!! Would highly recommend him and Stephanie.

Cash in hand above asking within 10 days!

Our home was on the market for 8 months with multiple failures to close and numerous frivolous and expensive repairs being made before we were introduced to Andy. Within 10 days after we selected Andy as our realtor we had closed with cash in hand above our asking price. Select Andy as your realtor as soon as possible because his enthusiasm, prompt actions, professionalism and expertise will likely yield a transaction experience that is as pleasant and profitable as possible.

Will work hard for his clients!

Andy did a great job for us in the sale of our house. We had relocated out-of-state and needed to just 'unload' our house. Andy was able to find us a buyer and close the sale. He is a great agent who will work hard for his clients. If you need a realtor, I can't recommend Andy enough.